How to Trade Stocks (Using Probability & Edge)

- FinancialWisdom

- Aug 22, 2022

- 7 min read

The foundation of every trading strategy.

CLICK PICTURE BELOW TO PLAY VIDEO

VIDEO TRANSCRIPT BELOW:-

In this video, we look at probability, its relationship to the stock market, and how we can stack the odds of success in our favour.

But first we need to understand probability. Most events can’t be predicted with total certainty, however we can gauge the likely hood through math and the idea of chance.

For example, the chances of being dealt a specific royal flush whilst playing poker, are 1 in over two and a half million hands, meaning you are more likely to be struck by lightning.

A more common event would be the toss of a coin, where there would be a 50% chance of the coin landing on either side, or a 1 in 2 probability.

There is however a clear difference between each of these events to that of the stock market and being able to predict future price. In the example of a royal flush, we are armed with fact, we know that there are a certain amount of cards of each type in each deck, this allows the law of math to provide a certain probability. Like that of a coin toss, we know there are two sides, and we therefore know for certain the probability of each individual toss.

The problem with stock prices is that the law of pure math is absent, there are far too many variables involved. We can however turn these variables to our advantage and manage them to improve our odds of success, which we touch on shortly.

Using the game of poker as an example, the fixed variables are the number of cards of each type in the deck. If we removed all the cards in the deck with a value of less than eight, we would improve our chances of getting dealt a royal flush considerably. Using a similar concept to trade the financial markets is exactly how we can improve our probability as a trader, we can add or remove certain aspects to our advantage.

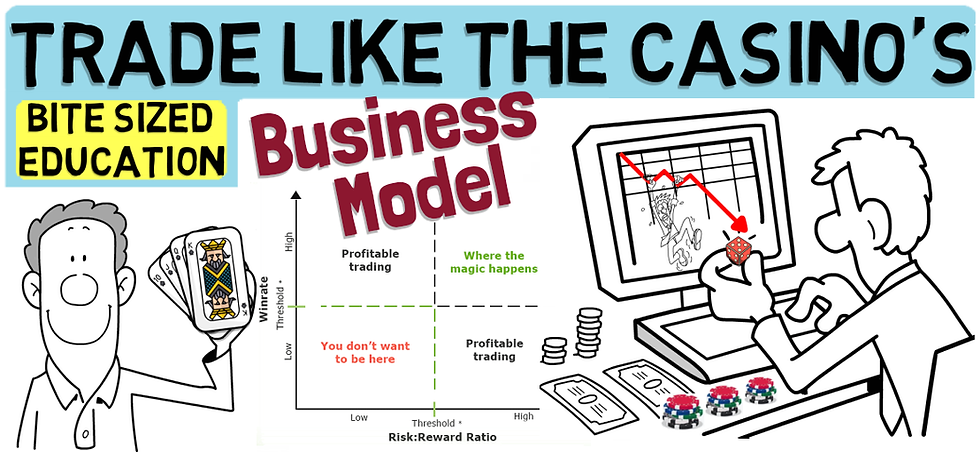

Improving your probability as a trader is also referred to as gaining an edge, let’s understand this a bit further to determine how an edge can result in profit. The best example is that of a casino, their business model is based on creating a small edge in each game and operating those games as often as they can. Roulette is arguably the most popular, let’s see how the casino calculates its roulette edge before we translate this to trading stocks.

In this American roulette table, we have a green double zero, and green single zero, with numbers ranging from 1 through to 36. If you placed a winning $1 bet on a number, the casino would pay out $36, meaning you get odds of 36 to 1, however due to the green zeros the true odds of you picking the winning number is actually 38 to 1. This means that the casino has a positive expectancy (or edge) over a long series of bets, of 5.26%, meaning for every $1000 wagered the casino would expect to profit $52.60.

Let’s imagine you walk into a casino with $100 and head to the roulette table, how much do you think you would likely lose after maybe four hours of play, based on this example and the casino’s edge materialising? I’ll give you a few moments to answer, why not let me know in the comments below before moving on.

Many people would reasonably expect to lose around $5 of their initial $100, if the houses edge of 5.26% played out. However most do not calculate that the edge applies to the total amount wagered and not simply the starting $100 amount.

Let’s assume you are betting $5 on each spin of the wheel, some spins win, and other spins lose. The wheel spins 50 times per hour, this equates to a total amount wagered of $250 per hour. Let’s assume you played for four hours, this would mean a total wagered amount of $1000. Multiply that by the casino’s edge of 5.26% and you would likely have lost $52.60, more than half of your initial $100.

Remember, it’s the total volume of bets (or trades) multiplied by a small edge that can make a huge difference.

The question is, how do traders improve their probability of success, create an edge, and apply enough trades to allow the edge to generate a profit?

First we need to understand that every trade, just like every toss of a coin, or every spin of a roulette reel, each event is completely random. Anything can happen in the short term, losing streaks and winning streaks are common, but with a large enough sample of trades or bets, the edge will eventually materialise. Try not to worry about the shorter sequence of events, look at the larger sample of trades over the longer term.

Interestingly, the longest streak reported on a game of red or black on roulette was reported in 1943, when the colour red appeared 32 times in a row, proving that anything can happen even in a game of equal chance.

Mark Douglas, author of Trading In The Zone discusses this concept in detail. Once you truly understand probabilities and the randomness of any game of chance, the journey becomes far easier.

Let’s look at this trading simulator which we have used many times before on the channel.

We assume we have a trading edge of 5.26%, the same as the roulette example we used. That translates into a win probability of 52.63% and the probability of losing at 47.37%. When we win, we win $50 and when we lose, we lose $50. After 1000 spins or 1000 trades we can see how the rolling profit and loss accounts would look like.

In the worst-case example, we realised a profit of just over $1000, but on average after 10 simulations of 1000 spins, we would have profited by around $2500.

The purpose of this example however is to show the potential variation of results despite the same probability. In the worst simulation, even though the edge materialised into a profit after 1000 spins, there was a considerable losing streak and drawdown. Even the best overall outcome shown in green saw periods of decline. This highlights that despite finding an advantage and an overall positive expectancy, anything can happen before we allow the law of averages to play out.

The benefit we have as traders over the casino however, is that we can limit our loss amount relative to the win amount. For example, by achieving a risk reward ratio of 1 to 2, equal to losing $25 when we lose, and winning $50 when we win, the equity profiles look completely different. We cover the importance of risk reward in more detail in our other videos.

Let’s look at improving probability to gain an edge in trading. There are unlimited factors to consider when trying to improve our chances of success and many lie within the framework of style. However the foundation for profitable trading comes from two concepts; The ratio of wins and losses (also known as win rate) and the ratio of how much you win when you win, relative to how much you lose when you lose. Both ratios must work in tandem with each other to achieve a positive expectancy.

If you have a strategy which offers a low win rate and a low-risk reward profile, you will likely fall into this segment meaning you will lose money. If you have a low-risk reward ratio you will need a very high win rate to be profitable, on the other hand, if you have a low win rate you will need to compensate it with a high risk reward ratio. My personal style offers a slightly higher than average win rate and a very favourable risk reward ratio.

Let’s pull this all together. To the right we have the portion weighted more towards risk and reward, and to the left we have the portion weighted more toward win rate. To improve win rate we can look at a number of factors, like technical analysis, news and stock fundamentals. I tend to favour technical analysis for the timing of a trade, and without being too exhaustive in this video, I put considerable weighting on trend and momentum.

When the general market trends in a certain direction, it’s likely that most stocks will follow a similar path. If your style is to buy pull backs, you would be improving your probability of success if the pull backs are within a positive overall trend. Likewise if you prefer trading continuation patterns, you would be best to do so when the whole market is moving in the same direction. “A strong tide lifts all ships” is certainly true with stocks too.

If you begin to add support and resistance lines accompanied with volume analysis, you really begin to move probability and therefore win rate into your favour.

Combining such analysis with great money management really enhances the positive expectancy of a strategy. Using the structure of price action allows us to use some rationale to limit losses, for example, knowing here that we had a supporting trend line under price, it would be reasonable to suggest that a stop loss to limit losses could have been placed here after price broke resistance. By doing so we have created an environment of limited risk, and unlimited reward.

Although we have not gone into depth, the theory remains the same for all styles and time frames, we want the best win rate combined with the best risk reward to achieve the best possible edge. Just remember that regardless of the edge anything can happen during the process, my personal strategy has periods of lack lustre performance, but in the long run I have probability on my side. If you want to see my strategy or join our group, then you are more than welcome by using the links below.

Don’t forget to hit the like button consider subscribing and I’ll ‘probably’ see you soon.

To learn more why not download my strategy or join our forum.

Access Our Group Here - https://www.financialwisdomtv.com/plans-pricing

My Breakout Scanner - https://bit.ly/3ea6sl8

My Forum - https://www.financialwisdomTV.com/forum

My Strategy Blueprint - https://www.financialwisdomtv.com/plans-pricing

My Brokerage Account (Interactive Brokers) - https://bit.ly/3HVA1nc

Have you calculated odds of buying index pull backs? I remember you saying you buy indexes when they pull back a certain amount (10%, 20%, etc) Does this still work when the general market trend is down?

Thanks for the great post @Old Contrary , always appreciated.

After being a GREAT fan of your work and having let MANY people know about them on Twitter since I discovered your great idea I've now received a slap in the face. I've also commented a number of times on various videos. I posted the following comment on your 'Trade like a Casino' video. I'm quite/VERY annoyed and disappointed as I don't know why you keep doing this? I even cleaned it up by removing the joke about golfing unless you are one (I used to B one too BTW). I don't know what is that's offending you or what it is that you think it is that might damage your business.

I like a bit of humour/satire, it helps…

Anything can happen, anything can happen, anything can happen!

So says Mark Douglas in the book, "Trading in the Zone Master the Market with Confidence Discipline and a Winning Attitude" mentioned above.

But, what about our core values?

I think some people (and hopefully most on this forum) will grasp the technicalities of trading, but do our beliefs allow us to succeed, and do our values matter?

From the book:

"A probabilistic mind-set pertaining to trading consists of five fundamental truths.

1. Anything can happen.

2. You don't need to know what is going to happen next in order to make money.

3. There is a random distribution between wins and losses for any given set of variables that define…