Risk of Ruin in Trading

- FinancialWisdom

- Aug 2, 2022

- 4 min read

How to Avoid it or Reduce its possibility.

The risk of ruin is when traders lose all or a large part of their trading capital, which pushes them to see trading in a bad light and leads them to quit trading for life.

If we go by the stats, a huge majority (99%) of traders never make enough money in trading. The 1% of savvy traders, who were also naïve in the beginning, end up taking all the money that the vast majority lose.

This was true when Jesse Livermore made his millions in the 1920s and 1930s and this is true today when Jim Simon’s Medallion fund rakes in billions using nothing else but data.

Though over 99% of traders don’t make any meaningful money, over 93% of new traders quit trading after 5 years of trading, and over 80% quit within the first 2 years. These are quite eye-popping metrics.

Most traders quit when they have no or little cash left to risk. Some also run into debt to fulfil the margin calls after taking irrational trades.

While the loss of a large part of capital is consistent between successful and unsuccessful traders, what differentiates the two is that successful traders persevere, learn about trading and come back with more capital to trade. They learn from their own past mistakes and get better over time.

On the other hand, unsuccessful traders display a lack of perseverance and either don’t try to learn at all or don’t try hard enough. Most of them never recover from their first setback, leaving trading forever. They come for the lure of easy money and leave when they realize there isn’t any.

The only difference here is hard work and mindset. It would be so much better if all new traders knew about the risk of ruin in advance and traded accordingly.

Even if a tenth of new traders are educated about this risk and a tenth of them actually put their house in order, that will double the number of successful traders in the data.

So, let’s start the education on reducing the ruin with the basics. Here are a few points you must remember when you are starting to trade.

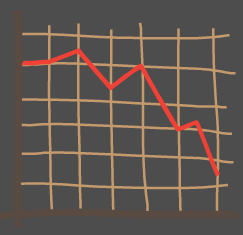

The markets are dynamic

The markets change every day and dream runs don’t last forever. It’s important to keep refreshing this concept and not get enamoured with the current state of the market. You must also not illtreat the easy money you have been making.

Generally, there are not many takers for such advice when the markets are on a roll. People who have tasted some success right away think they can do no wrong.

The result? They are caught unaware when the party ends. Worst, they get aggressive just at the wrong time, taking the probability of ruin to its highest level.

It will be easier to digest any crash or correction when you are prepared. The preparedness will help save your capital and get on the right side of the market, significantly reducing the risk of ruin.

See who is driving your returns (markets or you)

In continuation with the above, unhealthy overconfidence in profitable times makes you blind to the conducive overall market conditions.

A wise thing to do is to look at the market from a distance. If all sorts of stocks are making big moves, you know that you have a tailwind. When you are cognizant of good market conditions, make the most of it but also know that you would not have the same success if the market turns.

Just being aware of market tailwinds will not only keep you vigilant but also help you keep the returns when the market actually turns. This is contrary to an overconfident trader’s behaviour who would keep on trading the same way in bad markets and get hurt badly, losing his profits and capital.

Leverage your skill, not your capital

For newbie traders, markets offer a mouth-watering get-rich-quick scheme.

They would see the day’s low of a high-flying stock and note the day’s high of the same stock. He would then calculate the difference between the two prices and imagine the profits he could have made had he put his entire account in that stock at the low of the day, and sold at the high of the day.

Some more imaginative traders assume full leverage in their accounts and dream about even more profits for themselves.

When these traders actually start trading, they get to know the harsh reality in just a few trades.

It’s only human to have these thoughts, but it’s plain foolish to go all out with that greed. When you are starting out, you must take measured steps. Even those unreasonable expectations must be tested with a small part of your capital.

It’s okay to be stupid. But remember, you are a lot less stupid if you can get away unscathed from grave stupidity. Starting small helps you quite a lot in this area.

Give it enough time

You wont be making millions trading right after you start. You will have to go through your share of losses, frustration, and anxiety to become a successful trader. So, understand that it’s a long journey and you will be ahead of other unsuccessful traders by just deciding to push harder.

When you know it will be a long time before you taste meaningful success in trading, you will use your capital very judiciously. Being mindful of the long journey will keep you from making grave mistakes that can significantly reduce the risk of ruin.

The Final Word

Trying to keep your head straight when you aren’t making headway is quite challenging. Trying to do that when losses are mounting is even more challenging. So, don’t complicate the process and save yourself some mental energy by being aware of the risk of ruin and doing things differently.

Why not join our group below and learn from others who have either been through the journey or are just getting started.

My breakout strategy - 15 page rule book (PDF) is available for all members to use.

My Breakout Scanner - https://bit.ly/3ea6sl8

My Forum - https://www.financialwisdomTV.com/forum

My Strategy Blueprint - https://www.financialwisdomtv.com/plans-pricing

My Brokerage Account (Interactive Brokers) - https://bit.ly/3HVA1nc

@financialwisdomtv I wonder whether it might be useful to identify one's values, psychology and natural thinking style? if there was a way, then it might help with formulating a trading approach to suit each individual.

There are multiple ways to skin this trading cat! Yours truly tends to see the big picture, strategise and I think in terms of systems dynamics.

My two watch words and core process are "understanding discovery"

Others will have different values etc. Could a trading system be set up to suit a personality type?